Dear Issaquah Highlands Homeowners:

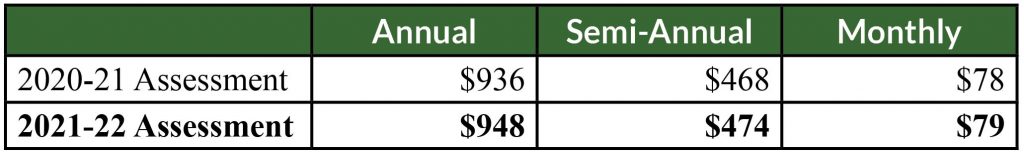

The 2021-22 Issaquah Highlands Community Association (IHCA) master annual assessment will increase by $12/year to $948 as of July 1, 2021, when ratified. There has not been an increase since the 2017-18 fiscal year.

The IHCA Finance Committee and IHCA Board of Directors reviewed the 2021-22 budget prepared by the IHCA staff. The IHCA is a nonprofit organization and develops the budget according to Washington state law and the IHCA’s Covenants, Conditions, and Restrictions (CC&R’s).

The Finance Committee works throughout the year analyzing monthly financials, including a yearly forecast. The committee started preparing and reviewing the 2021-22 operating budget at their meeting in January. The draft 2021-22 operating and reserve budgets were presented to and approved by the IHCA Board of Directors at the February 22, 2021 board meeting. Click here to view the 2021-22 approved budget >>

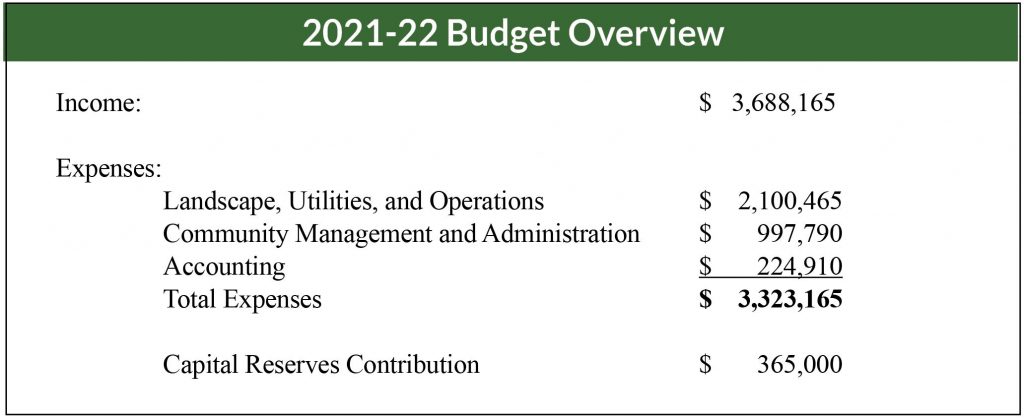

Income includes annual base assessments, late fees, shared-costs income, non-member income, interest, and other income. The unit count estimated for the 2021-22 budget is 3,571, including the Westridge North community, the latest Taylor Morrison residential development.

Income includes annual base assessments, late fees, shared-costs income, non-member income, interest, and other income. The unit count estimated for the 2021-22 budget is 3,571, including the Westridge North community, the latest Taylor Morrison residential development.

The operating expenses increased $132,000 (4%) over the last year’s budget. The increase is offset partially by an increase in base assessment revenue from additional unit absorption of the new Westridge neighborhood, west of 9th Avenue. The reserve contribution increased slightly and will provide the community with a strong financial position to fund future major projects.

Notable Expenses Increases:

- Landscape Contract: Vendor rate increases and Westridge neighborhood added.

- IHCA Payroll/Benefits: Additional staffing of one additional employee to manage the Custom Architectural Review Committee (ARC) transferring from the master developer to the IHCA; 401(k) match and annual wage increases.

- Professional Services: Custom ARC training, new community maps.

- Legal Fees: Additional legal services required.

Notable Expenses Decreases:

- Contingency: Lower projected needs for the community.

- Garbage/Electric: Savings in hauling debris; lower current electricity averages.

- Staff Uniforms: Contract with uniform supply contractor was terminated.

- Bad Debt Expense/Legal Collection Services: Reduction in delinquencies/collections.

IHCA 2021-22 Budget Ratification Meeting

Monday, April 26 at 5:30 p.m.

The IHCA 2020-21 Budget Ratification Meeting will be held via Zoom on April 26, 2021, at 5:30 p.m. Click here for the Zoom meeting link.

Per the Revised Code of Washington (RCW) and the IHCA governing documents, a quorum is not required at the meeting for the budget to be ratified. The budget will be ratified unless 75% of the entire membership (not just homeowners present at the meeting or by proxy) votes to reject the IHCA budget approved by the board of directors.

If you do not plan to attend the meeting, you may cast your vote in two alternative ways:

- Email: Send an email with your vote to budget@ihcommunity.org. Email must contain your full name and street address.

- By Mail: Send your vote with your full name, street address, and signature to:

IHCA – Budget

2520 NE Park Drive, Suite. B

Issaquah, WA 98029

All votes by email and by mail must be received no later than April 25, 2021, by 5 p.m.